What Do I Have to Do to Get My Second Stimulus Check

By Christine Tran, 2020 Go It Back Campaign Intern

In 2022, you can visit GetYourRefund.org to merits any stimulus checks you oasis't gotten . Y'all will demand to file a 2020 tax return to get the offset and second stimulus checks and a 2021 tax return to become the third stimulus bank check.

If you didn't become your first, 2nd, or 3rd stimulus bank check, don't worry — you tin can still claim the payments as a tax credit and go the money equally part of your tax refund. The stimulus checks are a federal tax credit, known as the Recovery Rebate Credit. You lot will need to file a tax return to get the Recovery Rebate Credit.

How do I claim the Recovery Rebate Credit on my tax return?

Y'all can get the Recovery Rebate Credit by filing your taxes. The tax return y'all demand to file will depend on which stimulus checks you need to go. Regardless of which taxes you must file, you can visit GetYourRefund.org to file your taxes for complimentary.

Kickoff and Second Stimulus Check

You lot will demand to file a tax return for Taxation Year 2020 (which y'all file in 2021). The deadline to file your taxes this year was May 17, 2021. The tax filing extension deadline is October 15, 2021.

If you missed the filing deadline, y'all can nonetheless file your revenue enhancement return to go your beginning and second stimulus checks. If you lot don't owe taxes, at that place is no penalty for filing belatedly. If you owe taxes, you may be subject to penalties and fines for not filing or not paying taxes. The government may reduce your tax refund to pay for any taxes y'all owe and other federal and state debts.

To larn more nearly your options if you call back you owe taxes, read "Filing Past Due Tax Returns" and "What to Practise if I Owe Taxes but Can't Pay Them."

Third Stimulus Check

You volition need to file a tax return for Tax Yr 2021 (which you file in 2022). The deadline to file your taxation return is Apr 18, 2022.

Filing Your Taxes

Revenue enhancement software, such as MyFreeTaxes, H&R Cake, or TurboTax, volition automatically aid decide if you qualify for the Recovery Rebate Credit.

If your income is under $72,000, you tin can employ IRS Free File to prepare and file your federal income taxes online for free. If yous earn less than nigh $56,000, you can also use the IRS VITA Locator tool or visit AARP Foundation Revenue enhancement-Aide to find a costless revenue enhancement site virtually yous during the tax season.

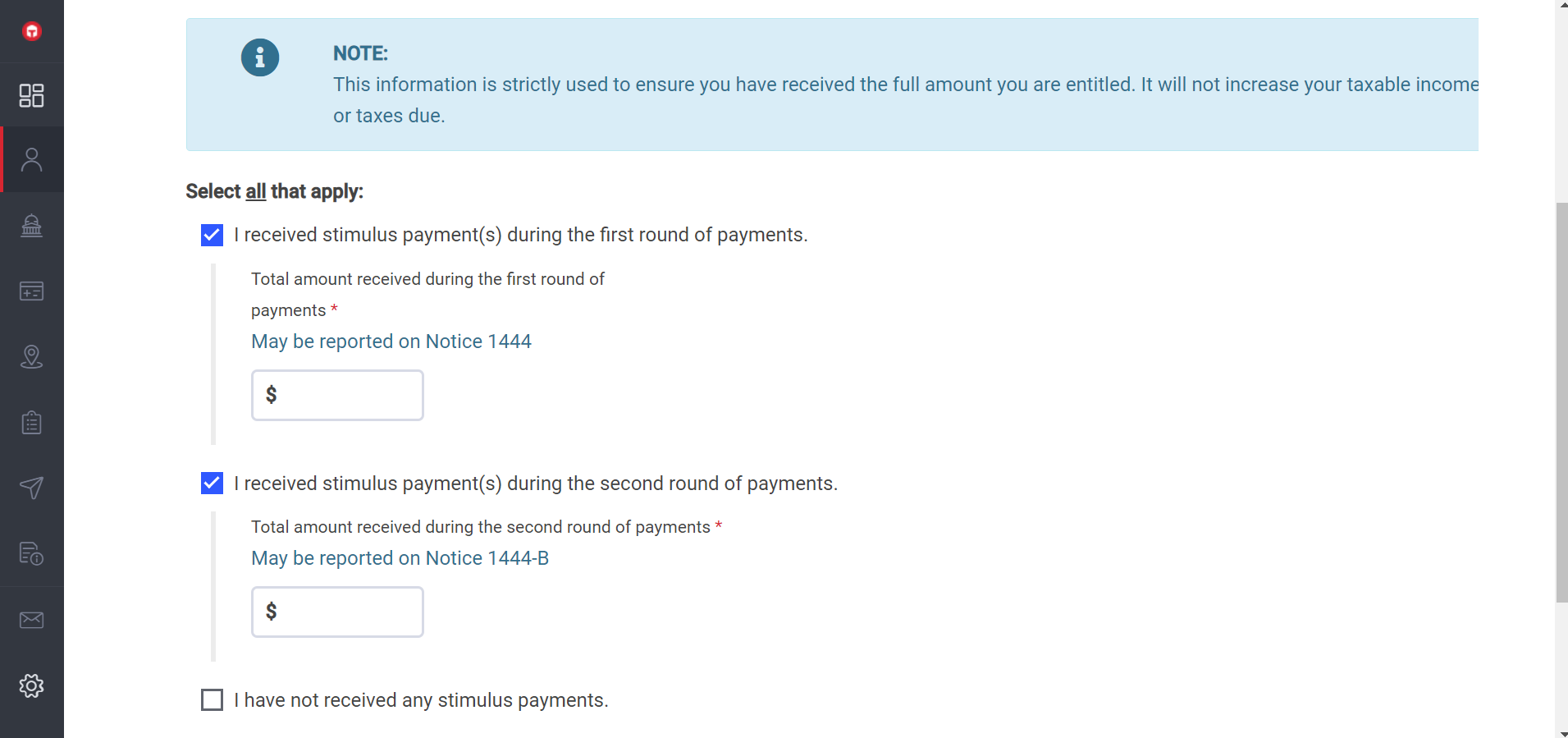

If y'all received your first, second, and/or 3rd stimulus check, yous'll need to know the corporeality you got for each check. If you lot need help finding the amount of your checks, click here. If yous oasis't received your stimulus checks, yous will be asked questions to help confirm your eligibility and the amount you are owed.

This is an example of how to claim the Recovery Rebate Credit through MyFreeTaxes revenue enhancement software.

The following sections provides information about who may demand to file to become each of the stimulus checks.

Showtime Stimulus Check

If you did not qualify for the first stimulus check based on your 2018 or 2019 taxes, y'all can claim the Recovery Rebate Credit if yous are eligible based on your 2020 tax return (which y'all file in 2021).

Here are some situations where you may need to take action to get the start stimulus bank check:

- If yous were claimed every bit a dependent on someone else'due south 2019 tax return (see Q C6), you were not eligible for a stimulus check. Yet, if that changed in 2020 and you run across the other eligibility requirements, you lot can merits the credit on your 2020 federal tax return (which y'all file in 2021).

- If you are incarcerated and did not receive your commencement stimulus check, yous can claim the taxation credit on your tax render.

- If your family unit was denied a stimulus check because merely one spouse has a Social Security Number (SSN), that rule has now changed. The spouse with the SSN and qualifying children with SSNs tin claim the outset stimulus check as the Recovery Rebate Taxation Credit. If y'all're a military family, only one spouse needs to have an SSN forboth spouses to claim the outset stimulus check.

- If your kickoff stimulus check didn't reflect all or your qualifying dependents (see Q C5) or if your income decreased in 2020 and y'all simply received a partial stimulus bank check considering of your 2018 or 2019 income (see Q B11), you can claim the additional coin by filing a 2020 tax return (which you file in 2021).

Second Stimulus Check

If y'all did not qualify for the second stimulus cheque based on your 2019 taxes, you tin can claim the Recovery Rebate Credit if you are eligible based on your 2020 tax return.Delight note that some of the second stimulus cheque eligibility rules differ from the first stimulus check.

Hither are some situations where yous may need to accept activeness to become the second stimulus check:

- If you were claimed as a dependent on someone else's 2019 revenue enhancement return, you were not eligible for a stimulus check. However, if that changed in 2020 and yous meet the other eligibility requirements, you can claim the credit on your 2020 federal tax return (which you file in 2021).

- If your 2d stimulus bank check was sent to a banking company account that is airtight or no longer agile, the IRS will not reissue the payment by mail. Instead, y'all will take to file a 2020 taxation return to the claim the payment as the Recovery Rebate Credit.

- If your second stimulus check didn't reverberate all of your qualifying dependents or if your income decreased in 2020 and y'all but received a fractional stimulus cheque based on your 2019 income, you can merits the additional money when you file a 2020 federal taxation return.

Third Stimulus Check

If y'all did not qualify for the 3rd stimulus cheque based on your 2019 or 2020 taxes, you can claim the Recovery Rebate Credit if you are eligible based on your 2021 tax return.

Here are some situations where you may need to take action to get the third stimulus bank check:

- If you lot were claimed as a dependent on someone else's 2020 taxation return, you lot were not eligible for a stimulus bank check. However, if that changed in 2021 and you meet the other eligibility requirements, you can merits the credit on your 2021 federal tax return (which you lot file in 2022).

- If your third stimulus check was based on your 2019 render or information received from Social Security Assistants, Railroad Retirement Board, or Veteran Diplomacy and yous did non get the correct amount.

- If your third stimulus check didn't reverberate all your qualifying dependents or if your income decreased in 2021 and you only received a fractional stimulus check considering of your 2019 or 2020 income, yous could claim the boosted money when you file your 2021 federal revenue enhancement return (which you file in 2022).

Finding the amounts of your starting time, 2d, and third stimulus checks

To detect the corporeality of stimulus payment(southward) you've received, you can:

- Refer to the IRS notices that were mailed to you.IRS Notice 1444shows how much you lot received from the first stimulus check.IRS Observe 1444-B shows how much you received from the 2d stimulus check. IRS Observe 1444-C shows how much yous received from the third stimulus check.

- Bank check your bank statements. If you had your payments straight deposited, you can find the amount of your get-go, 2nd, and third stimulus check using your banking concern statements. They should be labeled as "IRS TREAS 310" and have a lawmaking of either "TAXEIP1" (first stimulus check), "TAXEIP2" (second stimulus check), or "TAXEIP3" (third stimulus check).

- Request an account transcript. You tin can asking an account transcript sent electronically or by mail service using Get Transcript. You tin besides phone call the IRS' automated phone transcript service at 800-908-9946 or post in Form 4506-T to accept your transcript be sent by mail service.

- Create an account on IRS.gov/account. Y'all can view your stimulus check amounts under the Tax Records tab. If you filed jointly with your spouse, you will only see your half of the stimulus check amounts. Your spouse volition need to sign into their own business relationship to meet the other half of the stimulus cheque amounts.

To create an business relationship, yous will need:

- Basic information: total name, e-mail, birthday, Social Security Number (SSN) or Individual Tax Identification Number (ITIN), taxation filing status, and electric current address.

- A number from One of your financial accounts such equally the final 8 digits of your VISA, Mastercard, or Discover credit carte du jourorthe loan account number of one of the following types of loans: student loan, mortgage loan, dwelling equity loan, dwelling disinterestedness line of credit, OR an car loan.

If the above options don't work for you, y'all can provide the amount of your stimulus checks based on memory. The IRS volition correct the amount for you if you make a fault, which may delay the processing of your revenue enhancement render. The IRS volition notify you of whatsoever changes fabricated to your tax return.

If you are doing your taxes without the help of software, y'all can use the Recovery Rebate Credit Adding Instructions here (go to Step 3 and click "Didn't get your total stimulus check?").

When will I get the Recovery Rebate Credit?

You lot volition nearly likely get the Recovery Rebate Credit as part of your revenue enhancement refunds. If y'all electronically file your tax render, y'all volition likely receive your refund within iii weeks. If you mail service your return, it tin can take at least eight weeks to receive your refund.

Claiming the Recovery Rebate Credit will non delay your tax refund. However, if you don't claim the correct amount of the Recovery Rebate Credit, your refund may be delayed while the IRS corrects the error on your return. The IRS will ship y'all a notice of any changes made to your render.

You can check on the status of your refund using the IRS Bank check My Refund Condition tool.

Click here to larn how to get your stimulus checks.

Demand help with claiming the Recovery Rebate Credit?

This Free Revenue enhancement Filing folio can help you lot find the best resource to file your taxes for costless.

Source: https://www.taxoutreach.org/blog/what-do-i-do-if-i-didnt-get-my-stimulus-check-in-2020/

0 Response to "What Do I Have to Do to Get My Second Stimulus Check"

Post a Comment